Common Questions about Medicare Part C Explained

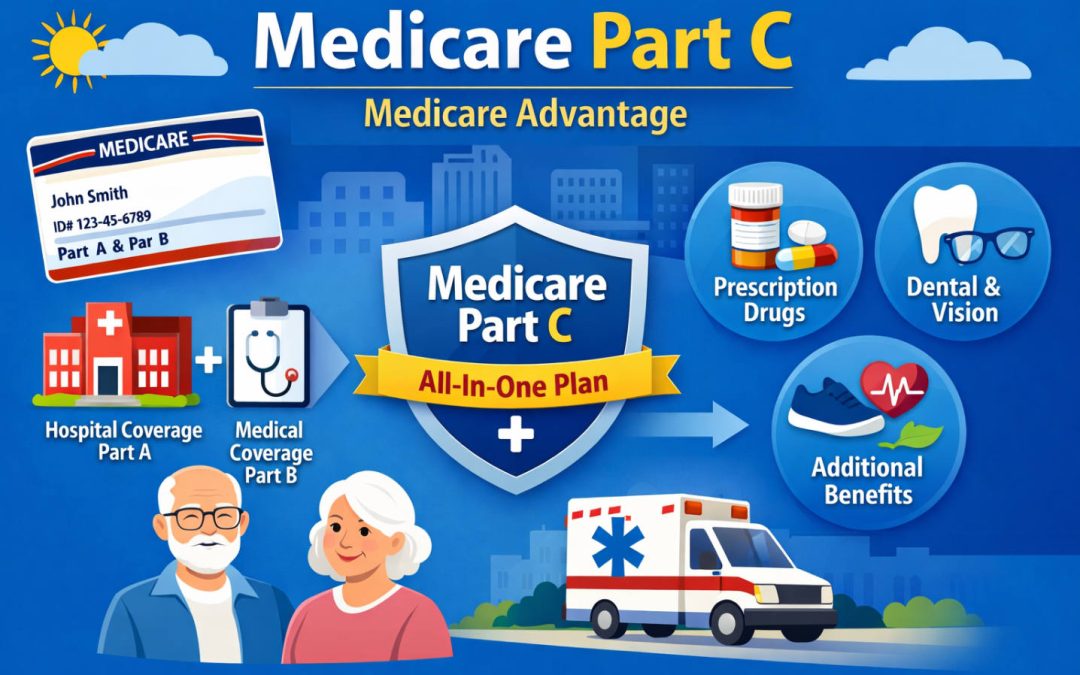

Quick Reference: Medicare Part C (Medicare Advantage) What is it? Private insurance alternative to Original Medicare, combining Part A (hospital), Part B (medical), and often Part D (prescription drugs) Who offers it? Private insurers approved by Medicare Coverage:...

What to Do if Your Medicare Disability Application is Denied

In Florida, over 65% of initial Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) disability applications—which determine Medicare eligibility—are denied. While this can feel discouraging, a denial does not mean the end of your journey...

Solving Common Medicare Coverage Confusion for Tampa Residents

Over 400,000 Medicare beneficiaries in Hillsborough County face Medicare coverage problems every day, and residents in Tampa are no exception. Tampa’s unique healthcare landscape, with its mix of large hospital systems and local providers, adds layers of complexity...

Medicare Part B Premium 2026: Tampa Guide

Quick Answer The Medicare Part B premium for 2026 is not yet officially released, but based on trends and recent announcements, Tampa seniors should prepare for a slight premium increase. Final 2026 premium rates are usually published each fall by Medicare. What Is...

Medicare Information Services Tampa

How to Choose the Best Medicare Services in Tampa Every year, thousands of Tampa residents face the complex task of selecting the right Medicare coverage. The variety of plans, options, and enrollment periods can feel overwhelming. The Medicare Information Project is...

Which Medicare Plan Is Right for Me in Brandon, FL?

Choosing a Medicare plan can feel overwhelming, especially with multiple options, different costs, and rules that affect your everyday healthcare. For residents of Brandon, Florida, the decision also depends on local provider networks, plan availability, and...

Should You Use an Insurance Agent for Medicare in Florida?

Quick Answer: For most Florida Medicare beneficiaries, using a licensed Medicare insurance agent leads to better coverage decisions, fewer costly mistakes, and long-term support without increasing your costs. This is especially true in Florida, where Medicare plans...

At What Age Can You Get Medicare?

Quick Answer: Most people become eligible for Medicare at age 65, but Florida residents may qualify earlier due to disability, ALS, or End-Stage Renal Disease (ESRD). Knowing when and how to enroll is essential to avoid lifetime penalties, delayed coverage, or...

Medicare Part D Options for 2026: How to Choose the Best Prescription Drug Plan

Nearly 50 million Americans rely on Medicare for their healthcare needs, and prescription drug coverage is a critical part of that care. If you live in Brandon, FL, and are looking at Medicare Part D options for 2026, understanding your choices can save you money and...