Quick Answer

For 2025, Tampa (Hillsborough County) offers ~70 Medicare Advantage plans, with an average premium around $3.85 and many $0 premium options. Compare network fit, drugs, and MOOP to choose confidently, especially during AEP (Oct 15–Dec 7).

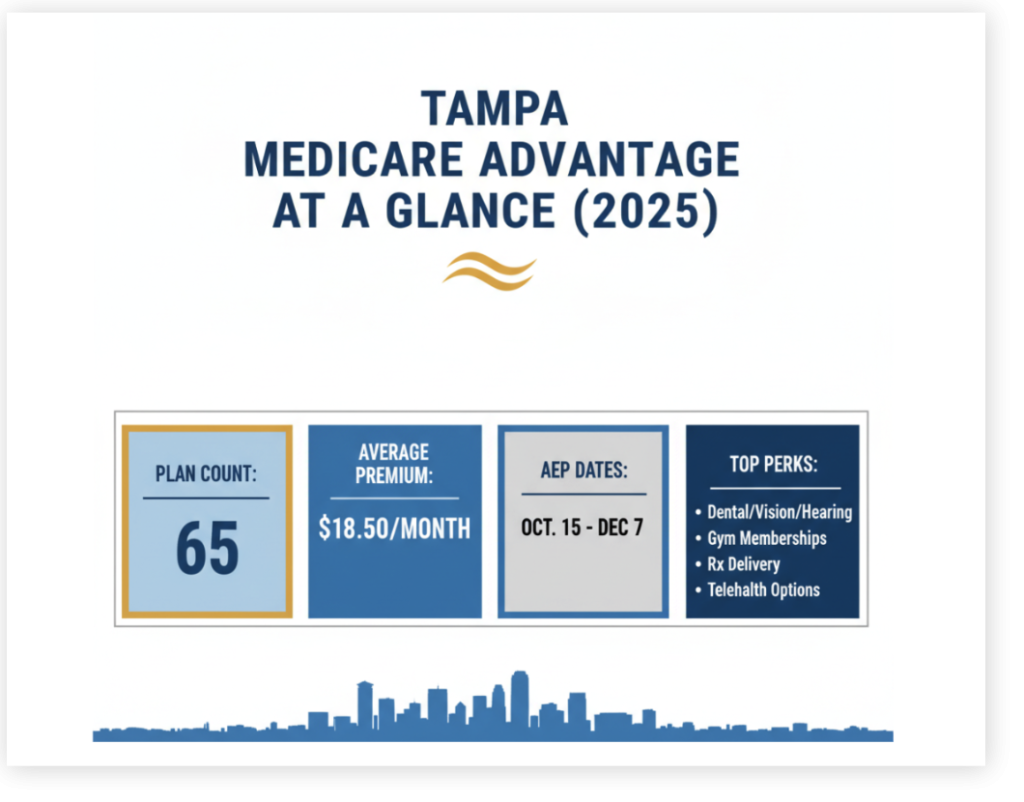

For 2025, there are over 60 Medicare Advantage plans available in the Tampa area, offered by carriers such as Optimum HealthCare, UnitedHealthcare, Humana, Aetna, Devoted Health, and Simply Healthcare. Many plans feature low or $0 monthly premiums, but it’s smart to compare the specifics (doctors in network, drug costs, maximum out-of-pocket) to find your best match.

Locally, residents in ZIP codes 33602 and 33603 often ask about Tampa General, BayCare, AdventHealth access and extra benefits like dental, vision, and fitness—all things we help you check before you enroll.

Talk to a local Tampa Medicare agent »

How many Medicare Advantage plans are in Tampa for 2025?

-

Hillsborough County residents can shop ~70 unique plans across HMO, PPO, HMO-POS, and SNP options.

-

Intense local competition (UnitedHealthcare, Humana, Aetna, Devoted, Optimum, Simply) keeps premiums low and perks strong (OTC, dental/vision, wellness).

-

Average premium ~ $3.85; many $0 premium choices are available.

Micro-Q&A

-

Q: Is a $0 premium plan really free?

A: You’ll still pay your Medicare Part B premium and any copays/coinsurance. Compare MOOP to understand your risk.

Helpful resources:

Plan types in Tampa (HMO vs PPO vs HMO-POS vs SNP)

|

Plan Type |

Network Rules |

Referrals |

Out-of-Network |

Typical Premium* |

Good Fit For |

|---|---|---|---|---|---|

|

HMO |

Must use in-network PCP/specialists |

Usually required |

Generally not covered (except emergencies) |

Often $0–low |

Want lowest costs and a tight local network |

|

PPO |

In-network preferred |

Not required |

Allowed at higher cost |

$0–moderate |

Want flexibility or see snowbird providers |

|

HMO-POS |

HMO core + some OON |

Usually required |

Limited OON with higher cost |

Low–moderate |

Want HMO savings with occasional OON |

|

SNP |

Tailored networks |

Varies |

Limited |

Often $0–low |

Dual-Eligible/Chronic conditions or LTC |

*Premiums vary by plan; check MOOP and drug tiers for the full picture.

Micro-Q&A

-

Q: Which is better, HMO or PPO in Tampa?

A: HMO often wins on cost; PPO wins on flexibility. We’ll map each to your doctors and medications.

Deep-dives:

What to compare (so you don’t overpay)

-

Doctors & hospitals: Are your PCP/specialists and Tampa facilities (e.g., TGH, BayCare, AdventHealth) in network?

-

Prescriptions: Check the formulary tiers, preferred pharmacies, and mail-order costs.

-

Total annual cost: Add premium + copays + coinsurance + MOOP.

-

Extra benefits: Dental/vision/hearing, fitness (SilverSneakers), OTC cards, post-hospital meals, transportation, and telehealth.

-

Star Ratings & utilization rules: Look at 2025 ratings and prior auth on key services.

-

Travel & snowbird needs: See PPO coverage or visitor/travel benefits.

Micro-Q&A

-

Q: How do I quickly see my total cost?

A: Use our Medicare cost/penalty calculator and a side-by-side plan grid.

Tools & help:

Enrollment windows (don’t miss your date)

-

Initial Enrollment Period (IEP): 7-month window around your 65th birthday or Part B start.

-

Annual Enrollment Period (AEP): Oct 15 – Dec 7 — switch, join, or drop a plan for Jan 1 coverage.

-

Open Enrollment Period (OEP): Jan 1 – Mar 31 — if you’re in MA, you can switch MA plans or return to Original Medicare.

-

Special Enrollment Periods (SEPs): For moves, loss of coverage, Medicaid changes, etc.

Micro-Q&A

-

Q: I’m still working at 65 in Tampa — do I enroll now?

A: Maybe. It depends on your employer coverage size and HSA plans. We’ll review your specific situation.

Start here:

Local, no-cost help (Tampa & Hillsborough)

Prefer a local agent who knows Tampa ZIPs (33602, 33603) and provider networks? Our licensed team compares UnitedHealthcare, Humana, Aetna, Devoted, Optimum, Simply and more — at no cost to you.

-

Appointments in person or via telehealth

-

Drug list & doctor match

-

Side-by-side plan comparisons

-

Application support (and year-round service)

Micro-Q&A

-

Q: Do you work with multiple carriers?

A: Yes. We’re an independent local team — we compare plans across major carriers to fit your doctors and meds.

Get help:

People Also Ask (related searches)

Do Tampa Medicare Advantage plans include dental and vision?

Many MA plans add dental, vision, hearing, and fitness. Coverage limits vary — we’ll check annual maximums, networks, and whether implants/major dental are included.

Which Tampa plans have the lowest MOOP?

MOOPs can range widely. We’ll show $1,000–$7,550+ examples and flag in- vs out-of-network MOOP for PPOs.

Can snowbirds use Medicare Advantage in two states?

PPO and some travel benefits help frequent travelers. We’ll confirm visitor coverage, OON rules, and urgent/emergency provisions.

What if my doctor leaves the network mid-year?

You may have continuity-of-care options or a Special Enrollment Period in some cases. We’ll review timing and documentation.

Get the expert support that you need!

FAQs

1) When should I review my Tampa Medicare Advantage plan?

Annually during AEP (Oct 15–Dec 7) or anytime your health, meds, or doctors change.

2) Is a $0 premium HMO in Tampa a good deal?

It can be. Check primary care access, specialist referrals, drug tiers, and MOOP.

3) Are prescriptions cheaper at certain pharmacies?

Often yes. Preferred pharmacies in each plan’s network usually have lower copays.

4) How do I avoid late penalties?

Enroll in Part B/D on time or have creditable coverage. Use our calculator to estimate exposure.

5) What if I’m turning 65 in the next 3 months?

You’re within (or near) your IEP. Let’s time your Part A/B and choose a plan that starts exactly when you need.

Ready to compare Tampa Medicare Advantage plans? Get a no-cost, local review of your doctors, drugs, and perks — and enroll with confidence.

Book your free consultation or call your Tampa Medicare agent today: Medicare Agent – Tampa