Quick Answer:

There is no single “best” Medicare plan for all seniors. The right choice depends on your health, budget, and lifestyle.

-

Original Medicare with Medigap: Best for nationwide access and predictable costs

-

Medicare Advantage (Part C): Best for bundled coverage and added benefits like dental and vision

-

Part D: Best for affordable prescription drug coverage

Choosing the Best Medicare Plan

The best Medicare plan for seniors depends on personal factors:

-

Budget: Can you afford higher premiums in exchange for lower out-of-pocket costs?

-

Health needs: Do you need frequent specialist visits or ongoing treatments?

-

Doctors and prescriptions: Are your providers and medications covered by the plan?

-

Travel: Do you need a plan that works in multiple states or abroad?

If you are new to Medicare, our Medicare 101 guide explains the basics step by step.

Micro Q&A:

-

What is the cheapest Medicare option for seniors?

Many Medicare Advantage plans offer low or $0 premiums, though copays can add up. -

What is the most comprehensive Medicare option?

Original Medicare paired with a Medigap plan often provides the broadest coverage.

Medicare Options: At a Glance

| Plan Type | Pros | Cons | Best For |

|---|---|---|---|

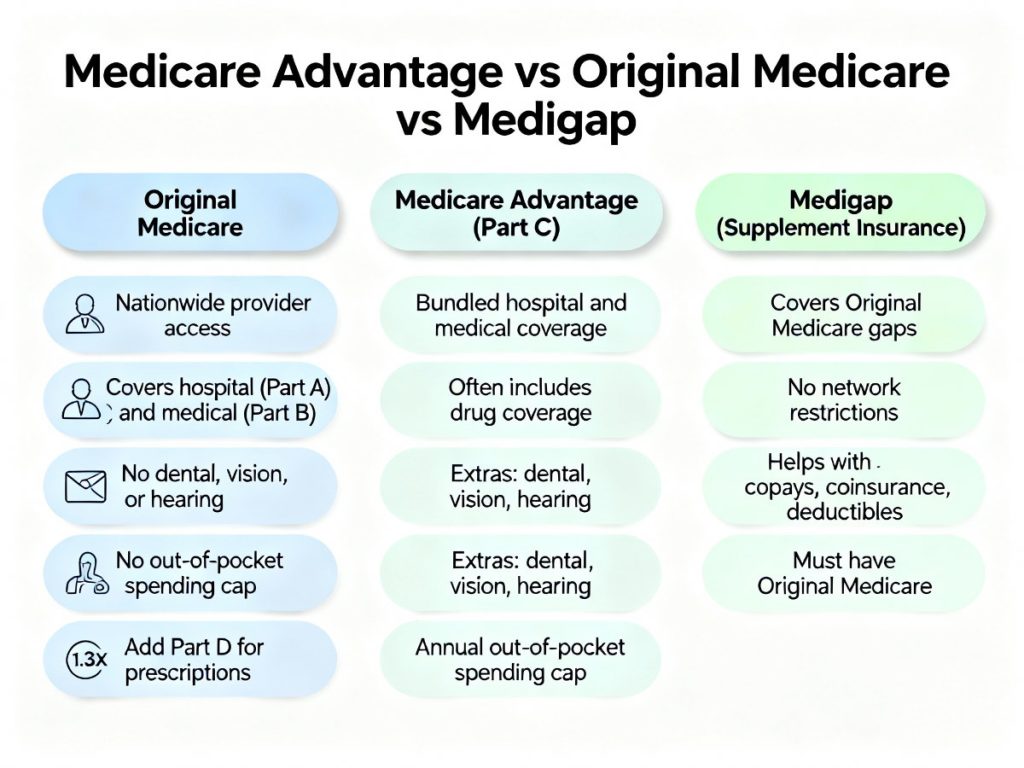

| Original Medicare | Flexible, nationwide provider access | No dental, vision, or out-of-pocket cap | Seniors who travel often |

| Medicare Advantage (Part C) | Bundled coverage, extras like dental and vision, low premiums | Must stay in-network, limited flexibility | Seniors who want lower upfront costs and extra benefits |

| Medigap (Supplement) | Covers deductibles and coinsurance, predictable costs | Higher premiums, no extras like dental or vision | Seniors with chronic conditions or frequent care |

| Part D (Prescription) | Affordable drug coverage | Must be paired with Original Medicare | Seniors who take regular prescriptions |

Option 1: Original Medicare (Parts A & B)

Coverage:

-

Part A includes inpatient hospital care

-

Part B covers outpatient visits, preventive care, and doctor services

What’s missing:

-

No coverage for dental, vision, or hearing

-

No annual spending cap

Add-ons:

-

A Part D plan for prescriptions

-

A Medigap plan to help with deductibles and coinsurance

Micro Q&A:

-

Do I need both Part A and Part B?

Yes, most seniors choose both to ensure hospital and medical coverage. -

Does Original Medicare include prescription coverage?

No, you must add a separate Part D plan.

Option 2: Medicare Advantage (Part C)

A private alternative that combines Medicare hospital and medical benefits, usually with extras.

Benefits:

-

Includes all Part A and B services

-

Often bundles drug coverage

-

Many plans add dental, vision, and hearing

Limitations:

-

Doctor networks may be restricted

-

Cannot be combined with Medigap

Compare Medicare Advantage options in Florida to see what’s available in your state.

Micro Q&A:

-

Are Medicare Advantage plans a good deal?

They are a good fit if you want low premiums and extra benefits. -

Can I switch back to Original Medicare later?

Yes, during open enrollment periods.

Get the expert support that you need!

Best Medicare Plans by Situation

-

Best for frequent travelers: Original Medicare + Medigap

-

Best for budget-conscious seniors: Medicare Advantage with low premiums

-

Best for seniors with many prescriptions: Original Medicare + Part D

-

Best for extra benefits like dental and vision: Medicare Advantage

-

Best for managing chronic conditions: Original Medicare with a Medigap plan

Top-Rated Medicare Providers

The best provider depends on location, but these carriers are widely recommended:

-

Aetna: Good for travelers with broad nationwide coverage

-

Humana: Offers many plan types and additional benefits

-

Cigna: Known for low-cost plans and positive member experience

-

Kaiser Permanente: High member satisfaction and strong drug coverage

Use Medicare.gov to compare available plans by ZIP code.

Micro Q&A:

-

Which Medicare plan is most popular?

Medicare Advantage now covers over half of seniors in the U.S. -

Which plans are highest rated?

In many states, Humana and Kaiser plans earn strong quality scores.

How to Compare and Choose Your Plan

- Check your doctors and prescriptions

- Compare premiums, copays, and deductibles

- Decide if extras like dental or fitness benefits matter to you

- Think about travel and flexibility needs

Try our Medicare penalty calculator if you are signing up late. For personal help, contact our licensed Medicare agents for free guidance.

Micro Q&A:

-

How do I know if Medicare Advantage is better than Original?

It depends on your health, budget, and whether your doctors are in-network. -

Can I get help choosing a plan?

Yes, Medicare agents provide free comparisons tailored to your needs.

FAQ: Best Medicare Plans for Seniors

Q1. What is the best Medicare plan for seniors?

There is no single best plan. It depends on budget, health needs, and whether you want extra benefits.

Q2. Which Medicare plan is most affordable?

Many Medicare Advantage plans offer $0 premiums, but out-of-pocket costs vary.

Q3. Can I have both Medigap and Medicare Advantage?

No, you must choose one or the other.

Q4. Which plan works best for chronic health issues?

Many seniors choose Original Medicare with a Medigap policy to keep costs predictable.

Q5. Do Medicare plans include dental and vision?

Only Medicare Advantage plans typically include those services.

Q6. How do I compare plans in my area?

Use Medicare.gov or speak with a licensed agent.

People Also Ask

What is the difference between Medicare Advantage and Medigap?

Medicare Advantage bundles benefits with a private insurer, while Medigap works with Original Medicare to cover out-of-pocket costs.

Which Medicare plan is best for seniors who travel?

Original Medicare with a Medigap plan usually provides the most flexibility for out-of-state or international travel.

Can I change Medicare plans every year?

Yes, you can switch plans during the Annual Enrollment Period, October 15 through December 7.